Mergers and Acquisitions Due Diligence Trends

In the realm of Mergers and Acquisitions (M&A), environmental due diligence is a pivotal aspect, essential for evaluating potential risks, liabilities, and costs, and ensuring adherence to environmental laws and regulations. This diligence profoundly affects transaction valuation, structuring, and negotiation.

The key to this process is verifying compliance with environmental regulations at target facilities, which encompass local, regional, and national laws and standards related to pollution, waste management, resource use, and other environmental aspects.

Conducting All-Appropriate Inquiries (AAI) is vital for assessing a property’s environmental conditions and potential contamination liabilities. Under CERCLA 101(35)(B), following established commercial and customary standards, these inquiries are crucial for certain CERCLA liability defenses, including bona fide prospective purchaser, innocent landowner, and contiguous property owner defenses. These defenses require the landowner to demonstrate AAI completion before property acquisition.

Environmental regulations like CERCLA can extend liability beyond the actual facility or business owner, potentially impacting lenders in certain scenarios. Entities acquiring contaminated property are liable for remediation, regardless of their role in the contamination. While they can seek indemnity or contribution from former owners, authorities can still hold the current owner accountable.

Evaluating potential liabilities from waste generation and disposal, both current and historical, is critical. This includes considering future regulatory actions, adhering to continuing obligations related to ongoing cleanup or monitoring, cleanup costs, and potential legal conflicts or penalties.

In share purchases, buyers typically inherit all environmental liabilities of the corporate target. Conversely, asset purchases may allow acquiring assets without inheriting certain liabilities, especially those linked to historical issues.

Environmental liabilities can significantly affect deal valuation. Buyers may negotiate lower prices or specific indemnities for significant environmental risks, while strong compliance records can enhance value.

Mergers and Acquisitions in Industry and Manufacturing

Due to higher inherent environmental risks, industries like manufacturing, chemicals, and energy necessitate more thorough environmental assessments. Furthermore, even though operational aspects of these facilities may not represent likely sources of contamination, they may still present the threat of future release if they are not well managed and have business risks related to regulatory noncompliance. Features such as air permitting and wastewater management are important to consider, as large fines or even temporary injunctions against one or more processes can result in a significant financial burden.

Environmental insurance products can manage risks identified during due diligence, providing a safety net against unexpected liabilities.

In bankruptcy transactions, unique environmental issues arise. Claims like ongoing noncompliance and remediation obligations often persist post-transaction.

A crucial aspect often overlooked is the requirement of regulatory approvals for some M&A transactions, which the environmental records of the companies involved can significantly influence. In today’s environmentally conscious world, the public perception of a company’s environmental stewardship, especially in environmentally sensitive industries, can greatly impact the success or failure of a merger or acquisition. This public image aspect necessitates a careful and proactive approach to environmental due diligence, aligning with regulatory standards and societal expectations.

A Sustainable Approach to Mergers and Acquisitions

As environmental justice, climate change, and sustainability become more central, the M&A approach is evolving. Companies are now scrutinized for their alignment with sustainable practices, including their carbon emissions, energy efficiency, and overall impact on climate. This scrutiny isn’t limited to their current practices but also encompasses future potential, especially for companies possessing cutting-edge green technologies or sustainable methods, as these can offer significant competitive advantages in the market. Furthermore, a critical consideration is the impact of a company’s operations on local communities, particularly in areas identified as disadvantaged and more prone to environmental hazards. The U.S. Environmental Protection Agency is placing greater emphasis on monitoring these areas. Therefore, companies involved in M&A must be aware of the importance of community engagement and building positive relationships with residents and officials, especially in these vulnerable areas.

In summary, environmental considerations in M&A go well beyond mitigating risks; they increasingly focus on leveraging opportunities for sustainable growth and aligning with evolving global environmental trends. These considerations necessitate a broader, more comprehensive approach to environmental due diligence, incorporating regulatory, public perception, and strategic planning for post-acquisition integration and sustainable growth.

Additional Resources:

Conducting Phase I Environmental Site Assessments (ESAs) is important to avoid significant financial risks for buyers and lenders. Inexperienced or unqualified consultants might overlook critical issues, making it vital to choose qualified environmental consultants. We recommend interviewing consultants to discuss project needs and assess their expertise to understand how they handle potential challenges.

It is essential to ensure the consultant’s qualifications. This process includes checking their educational background and professional certifications, such as Professional Geologist (PG), Professional Engineer (PE), and Certified Environmental Professional (CEP).

The ASTM International E1527-21 standard, effective in early 2023, is the current industry benchmark for Phase I ESAs. These assessments serve two primary purposes: due diligence — identifying potential contamination in real estate transactions, and liability relief — aiding purchasers in qualifying as bona fide prospective purchasers (BFPPs) to avoid liability for existing contamination.

To gain recognition as a BFPP, compliance with the All-Appropriate Inquiry (AAI) Rule is necessary. A Phase I ESA conforming to the current EPA-approved ASTM standard demonstrates this compliance.

Under Federal Law, the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) holds current property owners liable for environmental contamination in all but limited circumstances, even if the contamination occurred before their ownership. In some states, like New Jersey, claiming the Innocent Purchaser Defense requires additional assessment work.

Risks of Inadequate Phase I ESAs

The case of a financial institution versus an environmental consulting company underscores the risks associated with an inadequate environmental site assessment. The financial institution suffered considerable monetary loss due to an incomplete historical review, which failed to detect signs of contamination. Additionally, the property owner lost both the functional value of their property and the right to legal action against the assessment contractor, as they were not designated as “users” in the environmental report, facing potentially millions in cleanup costs.

A report from the USEPA released three months after the property transaction confirmed radioactive contamination on the site, previously utilized for hazardous material processing. Despite historical cleanup efforts, extensive radioactive contamination remained, with records dating back decades. This contamination significantly devalued the property and increased liabilities for the property owner and the financial institution.

For several months, the property owner delayed informing the financial institution about the contamination and related legal action. A new environmental consultant hired by the property owner estimated remediation costs to be between $4 million and $30 million. The property owner defaulted on their loan from the financial institution 33 months after its initiation, with a remaining balance of $3 million. Subsequently, the financial institution obtained a new appraisal for the property, which indicated an “as is” value of zero dollars.

Key Recommendations:

Risks of Using an Inexperienced Consultant

In the T&K Realty case, the environmental consultant performed a Phase I ESA for T&K Realty but failed to identify an underground storage tank despite evidence of a potential tank location. The consultant installed monitoring wells on the property as part of a Phase II ESA. During sewer line construction, workers found and uncovered a tank. They discovered a monitoring well drilled through the tank, releasing its contents. The tank, located next to a garage that serviced motor homes and other vehicles, contained volatile organic compounds like dichlorobenzene, 1,2-dichloroethene, methylene chloride, trichloroethene, benzene, ethylbenzene, naphthalene, toluene, trimethylbenzene, xylenes, solvents, and petroleum constituents. Complicating matters, the consultant used the sewer contractor to try to remove the tank, resulting in the contractor spilling most of the remaining contents on the ground. The release and subsequent spill resulted in groundwater contamination.

T&K Realty had to pay the costs incurred by NYSDEC, the costs to investigate the contamination and remediate the site, and legal costs. These costs amounted to hundreds of thousands of dollars.

Key Recommendations:

Conducting a Phase I ESA has become customary, but one should never underestimate its value. Collaborating with a qualified and competent Environmental Professional (EP) to ensure compliance with ASTM standards and the AAI Rule is essential. Failure to meet these requirements in a Phase I ESA could jeopardize the purchaser’s liability defenses.

Recognized Environmental Conditions – Best Practices

In the case of TC Rich vs. Shah Chemical Corporation (Shah)[1], an interesting situation arose regarding the recognition of a Recognized Environmental Condition (REC) during two separate Phase I ESAs conducted at separate times.

In the initial Phase I ESA TC Rich performed in 2005, they identified only one REC before purchasing the property and concluded that there was no contamination after soil sampling.

However, in 2015, TC Rich conducted another Phase I ESA to secure a loan. This time, the Phase I ESA identified the prior operations of Shah as a REC and initiated a Phase II ESA. The Phase II ESA revealed Tetrachloroethylene (PCE) contamination in soil, soil gas, groundwater, and even indoor air within the property building, consistent with discharges from Shah’s historical operations.

As a result, TC Rich initiated legal action against Shaw to recover toxic cleanup costs for the property, future cleanup costs, past damages, and attorney fees.

Importantly, TC Rich asserted that they neither caused nor contributed to the hazardous substance discharge on the property and had no prior knowledge or reason to believe that the property was contaminated. TC Rich took civil action against Shah for future cleanup costs and neither caused nor contributed to the contamination, leading to a settlement. If necessary, TC Rich could have used the “innocent landowner” defense under CERCLA.

Key Recommendations:

Conducting thorough Phase I Environmental Site Assessments (ESAs) is essential for uncovering and addressing potential environmental contamination and conditions linked to properties. Inadequate ESAs, often resulting from inexperienced consultants, can have significant financial and legal consequences for the owner, borrower, and/or lender. This is exemplified in various cases, including those detailed herein, which involved a major financial institution, an environmental consulting firm, and situations like T&K Realty and TC Rich.

Compliance with the AAI Rule is an important first step to qualify for the Bona Fide Prospective Purchaser defense under CERCLA, thus helping parties avoid financial liability for contamination caused prior to their ownership.

In summary, compliance with ASTM E1527-21 and the AAI Rule is essential for due diligence efforts to ensure legal protections and the performance of a thorough risk assessment to maintain confidence in real estate transactions, especially in urban and industrial areas with an environmental history.

References:

Conducting Phase I Environmental Site Assessments (ESAs) must navigate the complexities of fees versus liability to provide crucial services. Balancing these aspects is essential for mitigating future liabilities while ensuring thorough assessments during due diligence.

Environmental consultants face significant risks during Phase I ESAs. The potential environmental liabilities discovered often exceed the fees and profits from these assessments. Inadequately performed ESAs or overlooked environmental issues have led to substantial financial consequences for firms, sometimes amounting to hundreds of thousands of dollars. This highlights the importance of thoroughness and accuracy in these assessments to mitigate risk and protect the environment, the borrower or lender, and the consulting firm.

According to LightBox EDR’s historical data[1], the average fee for a Phase I ESA rose 11% from 2018 to 2023, with costs ranging between $1,400 and over $7,500. These variations reflect factors like the assessment’s complexity and the property’s characteristics.

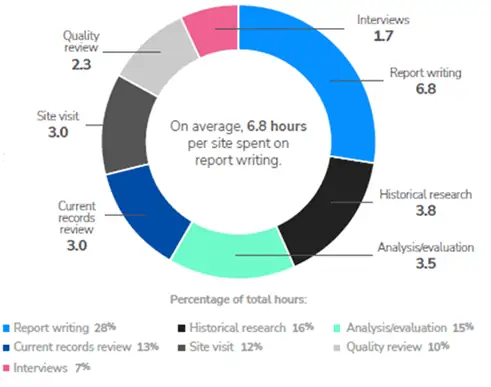

Report writing consumes the most hours in Phase I ESA-related tasks, LightBox EDR reports. The average hours per report across all aspects is twenty-five. A $75/hr. Consultant preparing the report costs $1,875, compared to $150/hr. Consultant at $3,625, not including profit and direct costs like travel, historical research fees, and regulatory fees. Investing more in a comprehensive ESA may be more cost-effective than missing a significant environmental issue.

Choosing a sub-$3,000 consultant for a Phase I ESA, regardless of the property’s apparent simplicity, could increase risks. Even straightforward properties can present unforeseen environmental challenges, affecting assessment accuracy and the project’s timeline and cost.

Firms conducting Phase I ESAs must adhere to professional standards like ASTM E1527-21 or local standards. Failing to meet these standards can lead to liability for missed or inadequately assessed environmental conditions.

The cost of a Phase I ESA reflects the required research and analysis, including a review of historical records, site visits, and potential environmental risk evaluation. Costs vary based on the expertise needed, especially for properties with complex histories or significant environmental issues and legacies.

Despite having professional liability insurance and contractual limitations of liability, firms can face significant business disruptions due to the time and expenses involved in litigation from oversights or inaccuracies in assessments.

Paying more for a Phase I ESA often results in a more comprehensive assessment. Higher fees enable exhaustive research, advanced technology use, and specialist engagement, leading to a thorough understanding of the property’s environmental status.

The fee for a Phase I ESA should align with the property’s specific complexities and risks. Industrial properties or those with hazardous material histories require more intensive assessment and review than simpler sites. However, low-risk sites can also reveal hidden environmental issues during assessments.

For example, a Phase I ESA on a rural property without apparent issues can become complex due to external factors like a neighboring gasoline tank leak. Such situations highlight the need for comprehensive and well-funded assessments to evaluate a property’s environmental status accurately.

The unpredictable nature of environmental risks emphasizes the importance of thorough and adequately funded Phase I ESAs to identify and address such risks effectively.

The implementation of ASTM E1527-21 in February 2023 introduced new considerations. This standard clarifies All Appropriate Inquiries (AAI) requirements and brings more precision to the assessment process. It mandates historical records for industrial properties, specific photographic and mapping requirements, and land title records detailing environmental liens or Activity/Use Limitations.

A notable update in E1527-21 is the approach to emerging contaminants. Until classified as a federal CERCLA hazardous substance, emerging contaminants like PFAS and PCB-containing building materials are optional in Phase I ESAs. This standard evolution reflects the dynamic nature of environmental assessments, where the cost of a Phase I ESA is a strategic decision to mitigate liability risks. Consequently, contaminants like PFAS and PCB-containing building materials, while not mandatory, can be included as a ‘non-scope consideration’ at the discretion of the Phase I ESA user.

While higher costs often lead to more thorough and reliable Phase I ESAs, balancing these costs with the property’s specific needs and risks is vital. The goal is a comprehensive understanding of environmental risks and conditions that support cost-effectiveness.

Investing more in a Phase I ESA is an investment in quality, risk management, and long-term cost-effectiveness, benefiting both the client and the consulting firm.

Phase I Environmental Site Assessments References:

North American developers and contractors are well aware of the high costs associated with transferring soil from developments. These costs only increase when some or all of that soil contains regulated contaminants such as petroleum hydrocarbons or metal concentrations. Due to past activity on properties, soil contaminants can test above safe background levels.

Keith Etchells discusses assessing and managing regulated waste soil and “clean” or inert soil to avoid additional expenses, risks, and delays when moving soil on your project is necessary. Using his expertise and California regulations as context, he covers the regulatory framework and legal requirements regarding proper soil transport and disposal, with best practices to avoid risk and liability.

Proper Planning – From Phase I ESA to Soil Sampling to Soil Management Plan

The California Water Code and Titles 23 and 27 of the California Code of Regulations are often interpreted to mean any soil with detectable concentrations of hazardous substances or metals above interpreted background levels as a “waste” upon excavation and export from a job site.

Based on the characterization of exported soil as waste, developers must discharge it to a waste management unit licensed and permitted for treatment or a disposal facility. These select facilities treat, store, dispose of, or reuse soils under appropriate local, state, and federal regulations.

Proactively and efficiently complying with regulations and minimizing the risks of improper disposal helps avoid project delays and uses a progressive assessment process. Assessment starts with completing a Phase I Environmental Site Assessment (ESA) report to identify the recognized environmental concerns (RECs) that may exist. Move to a second step if a Phase I ESA report indicates RECs or environmental concerns of possible soil impact.

What Constitutes Hazardous Waste?

Using soil sampling and analyses, complete a Phase II ESA. The findings of the Phase II ESA may indicate the presence of soil impacts from chemical constituents such as petroleum hydrocarbons, solvents, and pesticides.

Additionally, naturally occurring metals such as arsenic can be elevated from regional geologic sources at levels that exceed regulatory screening levels and disposal standards. Are these hazardous wastes? That depends on the concentrations and elevations of the chemical constituents or metals in the soil. Properties with previous land use often show concentrations of these constituents below hazardous waste levels but high enough to designate certain soils as regulated “non-hazardous” waste. Dispose of or recycle this waste at a properly licensed facility.

Whether profiling waste soil for off-site disposal at a licensed receiving facility or characterizing the extent and composition of ”clean” or inert soil for transportation to another nearby construction site that needs fill soil, guide the process and action using the soil sample collection and analyses for various constituents of concern. These are identified in the Phase I ESA report to facilitate approval for the various soil waste types at the appropriate disposal facilities.

Waste Profiling Data Requirements

Most landfill and treatment facility operators generally want waste profiling completed with no more than a year-old data. However, justifications can be made for using older data if it demonstrates that the soil samples still represent current site conditions. Proper design and completion of soil sampling plans by qualified professionals should provide sufficient data to answer important questions:

If you need to move clean soil:

Minimizing Cost Overruns and Project Delays

Early characterization of contaminated and inert soil provides much more confidence in disposal cost ranges used in project planning. Characterization also helps determine the feasibility of disposal strategies to limit the exported amount of impacted soil. They minimize potential litigation associated with toxic tort and improper waste disposal practices.

While some contaminants may not be present in concentrations below applicable screening levels, any detectable chemical constituents or metals above background concentrations are regulated waste, which costs more to export. Facilitating better communication between the selected grading contractor and your trusted environmental consulting company facilitates earlier soil characterization. Waiting until grading starts to test soil can cause project delays and increase the cost of rushed laboratory analyses and unexpected additional disposal costs to meet construction schedule needs.

With the help of your environmental consultant and consultation with design and construction team members, you can employ value-added strategies to reduce soil disposal costs. When requiring soil export on a job, one strategy involving soil with relatively low levels of contaminants below human health risk screening criteria but still considered a regulated waste entails the preferential reuse or burial of that soil on site.

Soil Reuse – Savings and a Lower Carbon Footprint

Reuse typically results in significant savings since it allows the preferential disposal of inert soil as opposed to the costlier disposal of impacted soil. This can be completed if the limits of the impacted soil versus inert soil are adequately delineated through prior soil sampling and analysis, which provides the confidence of knowing which soils are inert and which soils are impacted when it comes time to grade and export soil.

A qualified environmental professional with a proven background servicing the construction sector will guide you through the nuances of applying the appropriate regulatory guidance. These professionals can design various strategies to reduce soil disposal costs, often covering the cost of soil sampling and analysis while providing additional risk management and liability protection to your project.

The Benefits of a Soil Management Plan

The Soil Management Plan covers all aspects of properly handling and managing waste soils during development. Your consultant works with your design and, or construction team to develop the feasibility of soil management strategies best engineered to reduce soil disposal costs.

During the grading process, the environmental professional oversees the Soil Management Plan during the movement of impacted soil to minimize environmental risks from improper disposal during grading. Improper disposal can result in costly fines or recourse from an import site. Your project professional and plan will minimize delays that would otherwise result from the discoveries during grading of previously unknown soil impacts, such as underground fuel tanks or previous dumping areas.

Environmental oversight during grading and having a soil management plan in place are often required with regulatory oversight, whether through voluntary oversight programs or when regulatory oversight is a condition of obtaining a grading permit.

Clean Soil Export Considerations

Exporting fill material from a previously listed contaminated site may require local Regional Water Quality Control Board approval in California. Failure to properly assess whether these requirements govern your site could lead to costly fines from your state. The receiving facility may also need Regional Board approval. In my experience, the land owner and contractor could face liability in both scenarios.

Documentation for Large Developments

SCS Engineers supports a large infill development project requiring more than a million cubic yards of clean fill to achieve the final grade. Using a project-specific environmental and geotechnical import specification, we’ve identified potential sources from nearby construction projects and supply facilities to meet import requirements. It details the number of soil samples and laboratory analyses based on design and regulatory standards.

Whether the export site provides soil sample analytical data or the cost of soil sampling an export site is taken on by our client, SCS reviews the soil analytical data before soil import for adherence to import specifications. A “Clean” or Inert Soil letter documents the vetting process and quality of the imported soil. The developer avoids the risk of project delays due to inadequate sources of clean soil available or increased costs associated with importing soil if finding an acceptable local clean fill source proves difficult.

The Fine Print – Additional Fees May Apply

For example, any generator site in California incurs hazardous waste generation and handling fees when disposing of five or more tons of hazardous waste soil within a calendar year. The current rate is $49.25 per ton. The state requires that generators maintain waste manifests for each truckload of exported soil and weight tickets associated with any hazardous waste disposal so it can register and report hazardous waste disposal quantities to the California Department of Tax and Fee Administration. Failure to register and pay these state fees results in auditing and significant penalty fees. The generator will often need a temporary Environmental Protection Agency identification number.

Environmental planning for developers is often a complex undertaking. We hope this article and its explanation of soil transfer details from an environmental professional will help keep your project on time and within budget.

About the Author: Keith Etchells is a professional geologist and hydrogeologist with over two decades of experience assisting clients in managing environmental risks associated with the ownership, transfer, or operation of commercial, industrial, and waste disposal properties. Contact Keith if you have questions about soil remediation on LinkedIn or the SCS Professionals Directory.

Additional Remediation and Planning Resources:

SCS announces that Rachel McShane, a licensed environmental professional, is now working on the firm’s St Louis due diligence team. She is supporting the growing demand for SCS’s due diligence and brownfields redevelopment and remediation services in the region. McShane comes to SCS with nearly 20 years of experience, with particular expertise in Phase I and II environmental site assessments for both public and private sector markets, as well as client and personnel management.

McShane is a welcome addition to SCS’s clients who require due diligence services. “Lenders and developers need to understand what kinds of liability they may have if they’re lending on or buying a piece of commercial real estate. As CERCLA and state laws dictate, they may be responsible for some or all costs associated with cleaning up or mitigating property contamination. A solid, ASTM-compliant Phase I will give them a thorough background on the regulatory and development history of a given site and surrounding area,” states McShane.

Commercial developers and lenders depend on environmental professionals to use U.S. EPA rules and state regulations that prove they have conducted all appropriate inquiries regarding the property at the time of acquisition.

McShane explains: “An AAI-compliant Phase I ESA confers CERCLA liability protection and helps assure you know what you’re getting into when taking on a new loan or buying a new property. Even if a client is not particularly concerned about a given site being potentially eligible for entry into the Superfund program, it still behooves them to know what other contaminants could be present, as even minor releases can sometimes cost hundreds of thousands of dollars or more to address.”

Welcome to SCS Engineers, Rachel!

Additional Resources at a Glance

SCS Engineers periodically prepare SCS Technical Bulletins – short, clear summaries of rules, plans, and standards. In 2021, ASTM International published an updated consensus guidance document for evaluating environmental conditions at properties involved in commercial real estate transactions.

This SCS Technical Bulletin for the revised E1527-21, Standard Practice for Environmental Site Assessments: Phase I Environmental Site Assessment Process addresses definitions and terminology, clarifies industry practice for the historical records review of the subject and adjoining properties, and provides for updates and additions to appendices, report outlines, and other collateral.

Our updated edition now includes the revised guidance speaks to the business risk associated with emerging contaminants, such as Per- and polyfluoroalkyl substances (PFAS).

Read, share, download the A New Standard Practice for Phase I Environmental Site Assessments Tech Bulletin here.

For more information about Environmental Due Diligence, please visit our website.

Environmental due diligence is a form of proactive environmental risk management typically conducted before purchasing, selling, or leasing a property or business. Due diligence investigations can help prevent costly environmental liabilities by identifying them early in the transaction, thereby protecting all parties’ interests. There is an increased opportunity for significant cost-savings when the hired consultant accounts for tangential aspects during their investigation.

Environmental due diligence encompasses tangential aspects that are not the primary focus of the investigation. Aspects such as these may indirectly impact the environmental risks or liabilities associated with the property or business or the transaction’s overall feasibility or value.

Tangential Aspects of Environmental Assessment: A Case Study

A major oil company requested environmental due diligence for a large property acquisition. The property acquisition was part of a larger company acquisition and involved hundreds of oil and gas well locations, facilities, tanks, and equipment. It was necessary to modify the Phase I assessment for the work. Of the hundreds of well locations, 50 were chosen for Phase I work and field verification. According to the consultants, any environmental liabilities exceeding $2 million must be identified during this evaluation. Phase I examined the locations of wells for potential environmental liabilities, such as petroleum releases, but did not examine the wells themselves. Even though the consultants were experts in evaluating the condition of oil and gas wells, the oil company addressed this aspect of the investigation in-house. The company did not consider the tangential legal implications, liability for plugging costs, potential impacts on property value, and potential penalties for non-compliance with regulations.

Many wells excluded from the consultants’ due diligence were over 50 years old and out of operation. The company’s in-house investigators did not perform a field review. The result was an underestimation of the number of wells that required plugging and their associated costs. The estimate for plugging a well was between $20,000 and $30,000 per well. The plugging costs for this transaction were much higher, ranging from $80,000 to $120,000 per well, resulting in a $42 million increase. The oil company made a mistake in thinking the plugging costs were insignificant. Environmental due diligence should always include tangential factors.

Additional examples of tangential aspects of environmental due diligence might include the following:

The information obtained during or upon completing an investigation can inform negotiations and contractual arrangements between the parties involved in the transaction. Environmental consultants could spot some issues big enough to kill a deal. Other issues may allow buyers to adjust the purchase price or negotiate an indemnity to shift financial responsibility for environmental risk. It may also be possible to purchase environmental insurance for sufficient financial protection.

The specific steps involved in environmental due diligence depend on the type and scope of the transaction, as well as any applicable regulations or guidelines. Consult an experienced environmental professional to ensure that your due diligence process meets all your needs and requirements. Find out more about SCS’s environmental due diligence services.

The announcement of new developments, especially new housing, is always welcome, given nationwide shortages. Wood Partners recently spoke of its Alta Cuvee project in Rancho Cucamonga, CA., an area experiencing high growth rates. With the construction currently underway, the community plans to open in late 2024.

Careful development companies follow all environmental guidelines set forth by local, state, and federal agencies to ensure sustainability. At the Alta Cuvee project, SCS Engineers performed a Phase I Environmental Site Assessment, ensuring due diligence on the part of Wood Partners.

Today’s commercial real estate transactions take environmental issues into consideration. Complex laws can impose significant environmental liabilities on purchasers, sellers, and lenders, whether or not they caused the problem and whether or not they still own the property.

When looking for a new home, look for reputable companies that perform due diligence. When looking for environmental due diligence services, look for engineers and consultants providing comprehensive services for the welfare of future tenants, owners, and your firm’s reputation.

All Appropriate Inquiries (AAI) is a process of evaluating the environmental condition of a property and assessing the likelihood of contamination. Parties must comply with the requirements of the AAI Rule or follow the standards set forth in the ASTM E1527-13 or E1527-21 Standard Practice for Phase I Environmental Site Assessments to satisfy the statutory requirements for conducting all appropriate inquiries.

Learn more:

SCS’s Mike Miller explains the impact of the new ASTM E1527-21 Due Diligence Standard. Mike covers the history, CERCLA, defenses, and the changes impacting due diligence in the new Standard in this video. Watch it here. Use chapters in the timeline to jump from topic to topic at these start points:

Learn more about Environmental Due Diligence and All Appropriate Inquiries, and meet Mike Miller, SCS’s National Expert. Today’s commercial real estate transactions must take environmental issues into consideration. Complex laws can impose significant environmental liabilities on purchasers, sellers, and lenders, whether or not they caused the problem, and whether or not they still own the property. Environmental Engineers can help protect you and your investment.

SCS Engineers provides comprehensive environmental due diligence services nationwide and announces two new SCS National Experts to lead the expanding practice. Vice President Michael Miller and Project Manager Justin Rauzon take the helm to meet the expanding demand for these environmental services. Mr. Miller is in SCS’s Omaha, Nebraska location and Mr. Rauzon in the Long Beach, California headquarters office. Both professionals work nationwide and continue to support their regional clients in their new positions.

Both work through all project phases, from developing cost estimates to implementing due diligence tasks ranging from site assessments to full remediation. SCS Engineers’ Environmental Due Diligence and All Appropriate Inquiries practice is comprehensive. The practice’s services cover Environmental Insurance Claims and Underwriting Support, Financing and Company Acquisition Support, Property Inspections and Abatement, Property Transactions, and Solid Waste Management Financing.

SCS’s Brownfields and Voluntary remediation engineers rely on the due diligence practice and developers, contractors, municipal officials and city managers, and advisors such as banks, insurance firms, and attorneys to private and public entities.